Our Mission: Let's make democracy work better

The Common Good is one of the nation’s premier nonprofit, nonpartisan, pro-democracy organizations that promotes civil and informed discourse on major public policy issues. TCG provides opportunities for the dynamic exchange of ideas, taking partisan politics out of policy discussions. We encourage our leaders and our citizens to work together to solve our urgent problems. TCG has offered hundreds of events and programs, film screenings, and informational travel with top thought leaders to thousands of audience participants.

Upcoming Events:

Two important and fresh voices join us to discuss the pressing humanitarian crisis in Gaza, leadership in Israel, and the prospect of a two-state solution. Join us on Thursday, April 25th, from 3-4:00pm to hear from Maj. Gen. (Rt.) Amnon Reshef and Rula Jebreal.

Join us for an exciting discussion with the dynamic Rep. Dan Goldman at The Common Good Monday, May 6th, from 6-6:30pm on Zoom.

Don’t miss your chance to hear from Governor Hochul of New York, in-person, as she joins us to talk common sense governance at The Common Good.

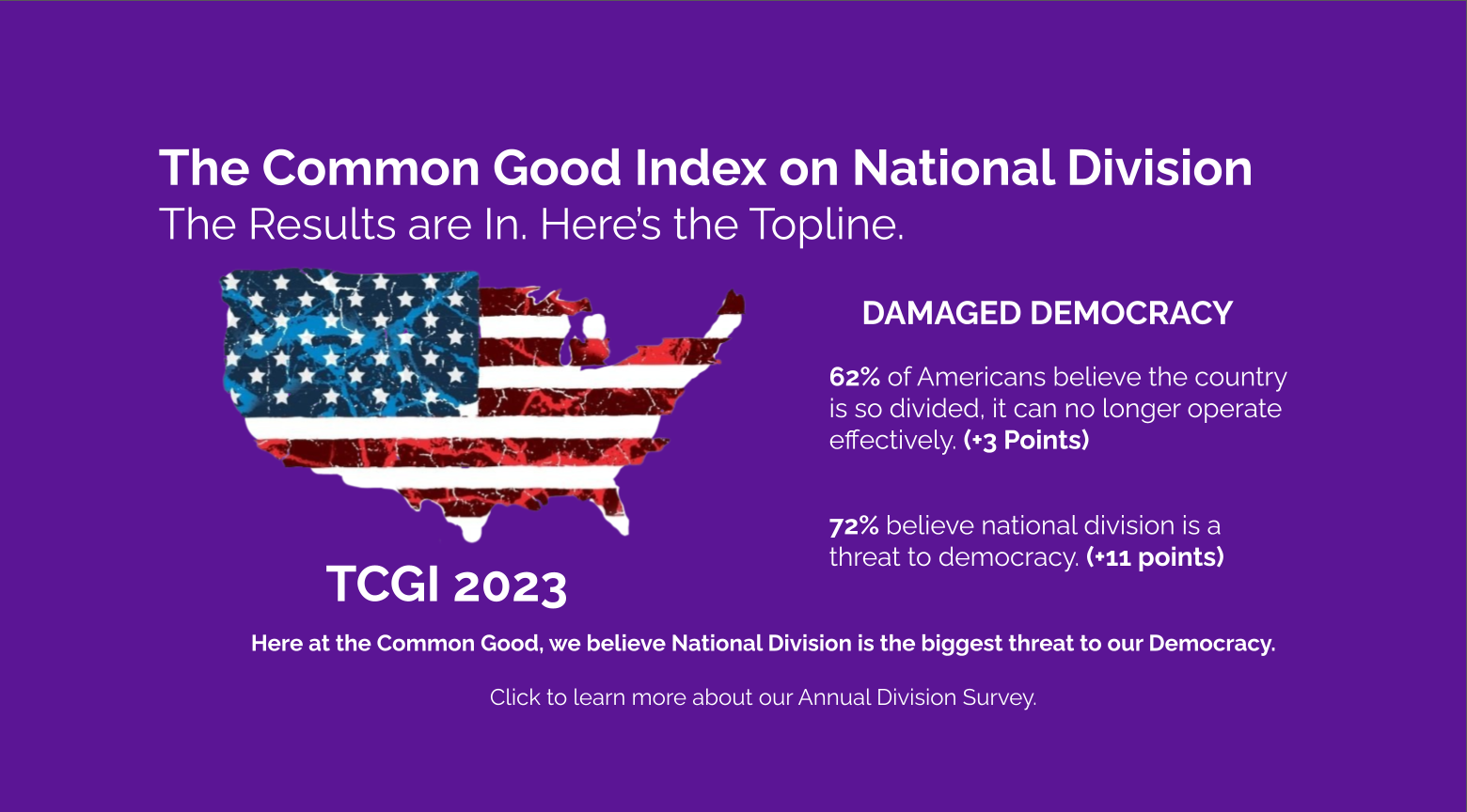

The Common Good Division Index 2023

Our annual national index that quantifies and tracks levels of division, identifies causes and seeks ways to establish a unifying and constructive national dialogue.

Conducted by The Common Good in association with Emerson College Polling, TCGI is based on a national multimodal survey of 1000 18+ U.S. residents.

National Security expert and former Chief of Staff at the U.S. Department of Homeland Security under the Trump administration, Miles Taylor, brings his urgent insights to The Common Good, as he dives into the ramifications of a potential 2024 Trump presidency.

Senior Managing Director & Chief investment Strategist at Blackstone, Joe Zidle - joined The Common Good for an important and timely conversation on the economy, the markets, and political and international events that may affect your portfolio, your business, or simply your peace of mind. Tune in Now!

Last Wednesday, The Common Good welcomed media expert and former CNN host, Brian Stelter for a riveting session unpacking his investigative reporting into Fox News and Trump, and exploring the impact of disinformation on politics, the news, and our nation’s growing division. Tune in now #EngageEducateEmpower

In an age characterized by technological advancement, the rise of artificial intelligence has sparked a cascade of questions concerning its impact on both society and national security. What are the risks? How can we effectively manage the rapid acceleration of AI innovations? With expert in defense and AI, Paul Scharre, and Gideon Rose, Sr. Fellow at CFR.

A time-sensitive discussion on a possible path to a resolution for the Palestinian-Israeli conflict, with distinguished professor Dr. Nathan Brown and Dr. Tahani Mustafa, Senior Palestine Analyst for the International Crisis Group, in conversation with acclaimed journalist Richard Wolffe, columnist at The Guardian and managing director, Jose Andres Media.

Bill Browder was the largest foreign investor in Russia until he was denied entry into the country in 2005 and declared a threat to national security. His crime? Exposing corruption in Russian state owned companies. He has a lot of experience dealing with Russia and particularly with Vladimir Putin. He will discuss Putin’s place on the world stage, the invasion of Ukraine, and the threat that Putin poses to the Western world order as Ukrainian defenses languish at a stalemate.

As the Israel-Hamas war rages on, there are many looming questions about how this will play out for Israel, for Palestinians in Gaza and the West Bank, and for the eradication of Hamas; the humanitarian concerns for civilian lives in Gaza; the release of the hostages still held by Hamas; and Israel's longterm security concerns. What military and diplomatic solutions are still on the table to prevent a multi-front war?

A discussion on the evolution of warfare up to Putin’s invasion of Ukraine, the current conflagration in the Middle East following the Hamas attack on Israel, and the potential escalations between China and Taiwan. Petraeus explores the mistakes made over and over, the new weapon systems, theories and strategies, and anticipate in the future in order to navigate an increasingly perilous world.

Prominent Israeli journalist Nahum Barnea joins Pulitzer-winning journalist Judith Miller at The Common Good for an urgent and critical session on the events in the Middle East prompted by Hamas’ shockingly savage attack on Israeli citizens and followed now by Israel’s unrelenting strikes on Gaza, home to millions of Palestinians, in the effort to eradicate Hamas.

As Ukraine and Israel, rare outposts of democracy in difficult regions of the world, simultaneously face existential crises caused by fierce and bloody incursions, the U.S. finds itself paralyzed with a rudderless Congress, some of whose members, instead of seeking ways to fund the defense of both these allies, pit one against the other.

Amidst record-breaking temperatures, powerful storms, widespread flooding, raging wildfire, and July 2023 being recorded as the hottest month ever recorded globally has painted a stark reality of the existential crisis gripping our world: climate change.

The ever-evolving dynamics between the United States and China hold a global spotlight, with implications that reverberate well beyond their respective borders. Navigating the complexities of this critical bilateral relationship, characterized by both cooperation and contention, bears profound significance for the state of global affairs.

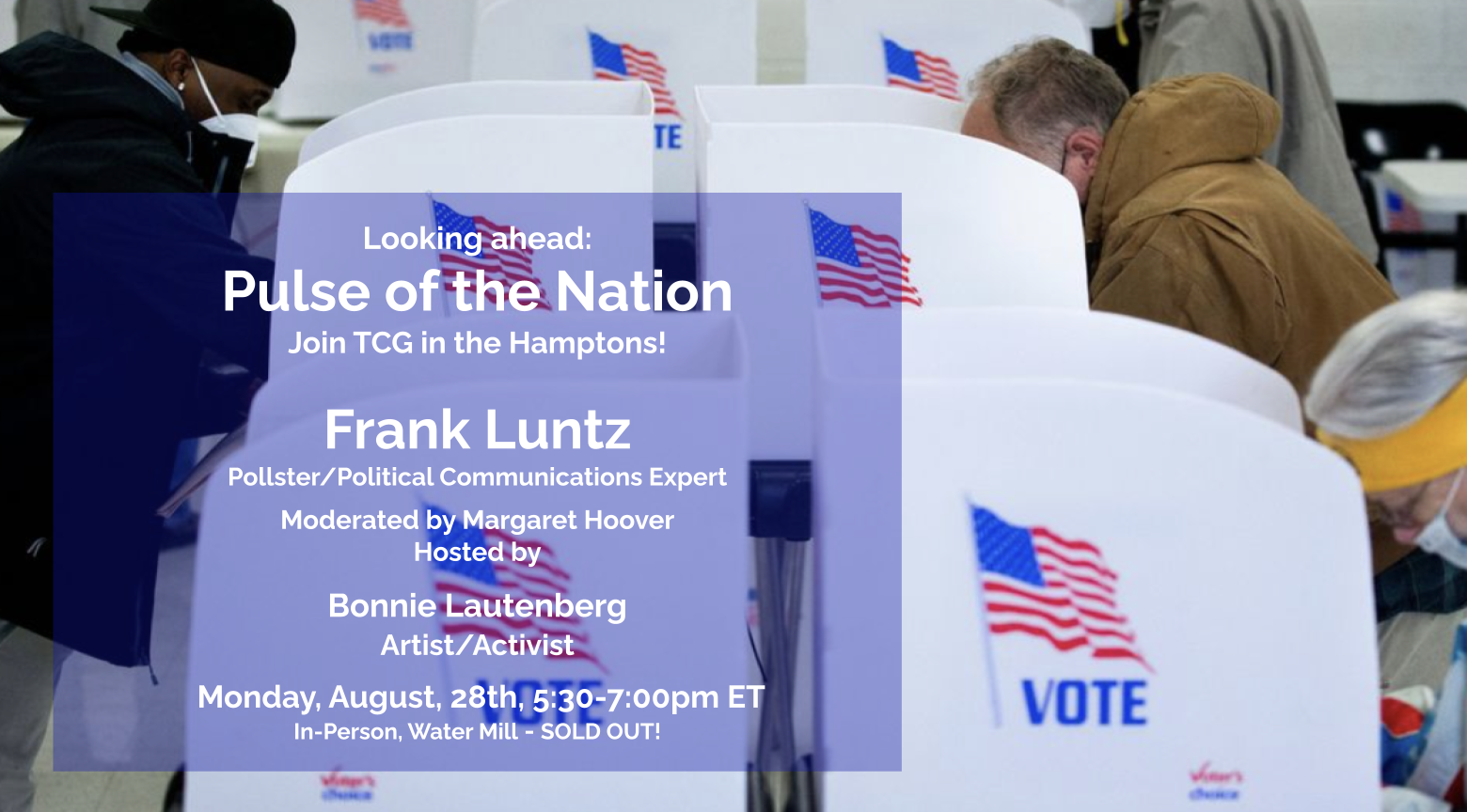

How has public opinion shifted? The events within the recent election cycles have struck at the core of our nation and the heart of our democracy. As we look ahead, curiosity abounds: What lies on the horizon? How do voters currently position themselves, and what insights can we draw from diverse demographic perspectives on pivotal matters?

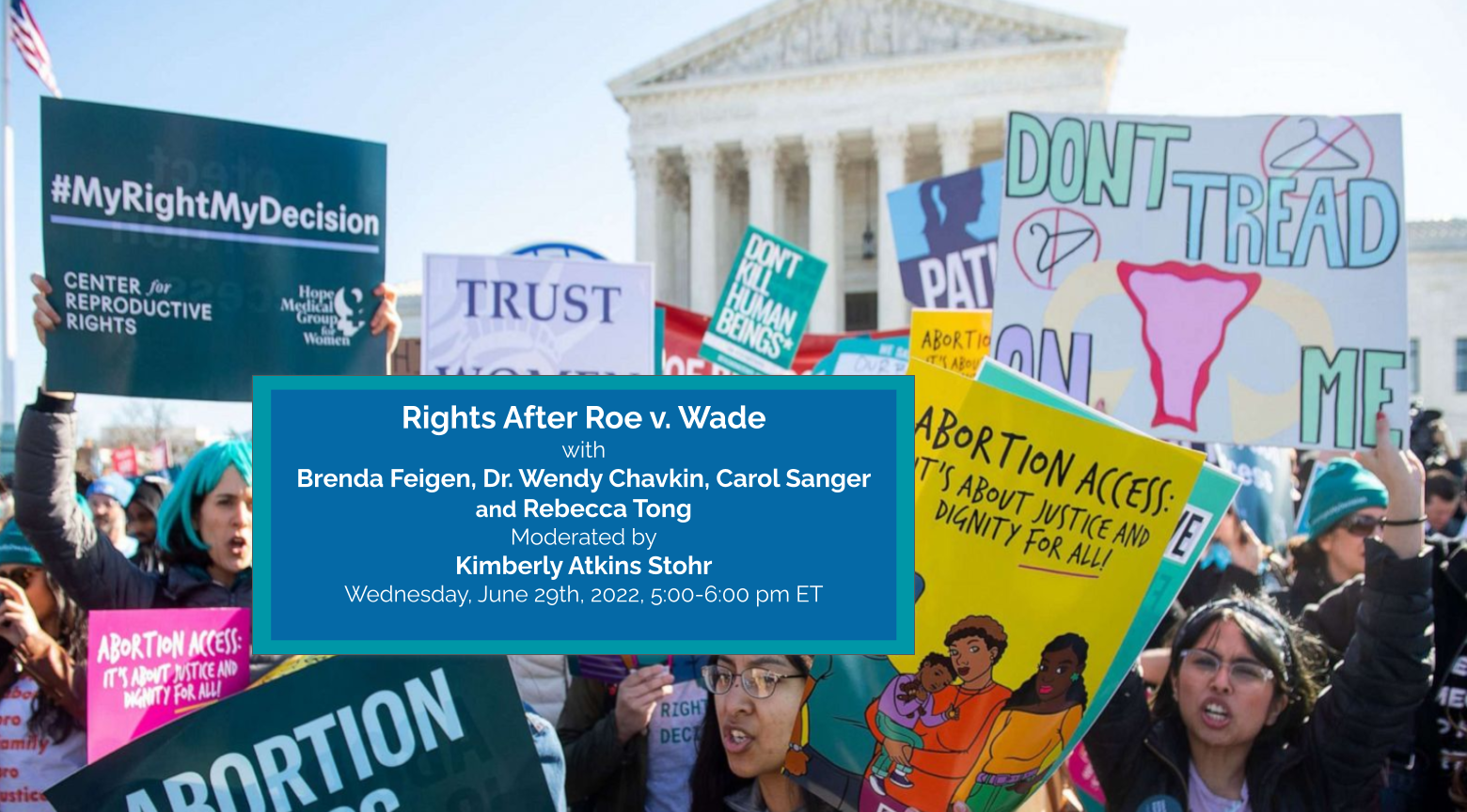

The new conservative Supreme Court concludes its term with a bang -- having delivered some of the most significant rulings in modern times. Consequential decisions on issues have ranged from rulings on voting rights, affirmative action, student loans, election law, free speech and LGBTQ civil rights, to its landmark overturning of Roe v. Wade on reproductive rights.

The fall of Tucker Carlson, a nearly $800 million fine levied against Fox News, and the rise of AI. Can the news media still be trusted? Is there a remedy? We brought in Angelo Carusone, president of the premiere media watchdog organization Media Matters, to tell us what we need to know.

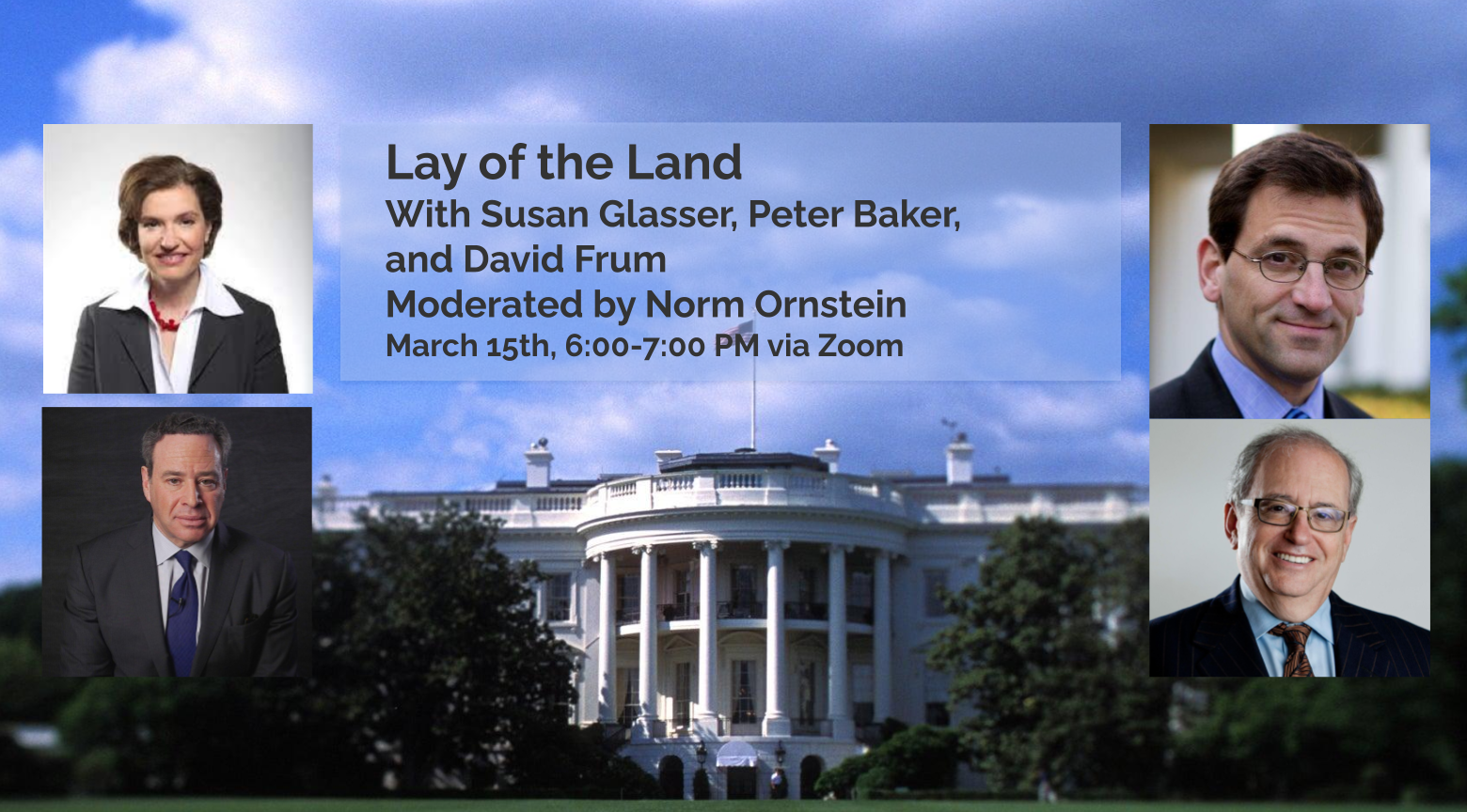

How has our democracy and the two parties changed – given the turn to the radical right in the Republican Party even after Trump’s 2020 defeat and Biden’s sometimes rocky two years in office? The Common Good has brought together renowned journalists Susan Glasser, Peter Baker, and David Frum lead in discussion by Norm Ornstein.

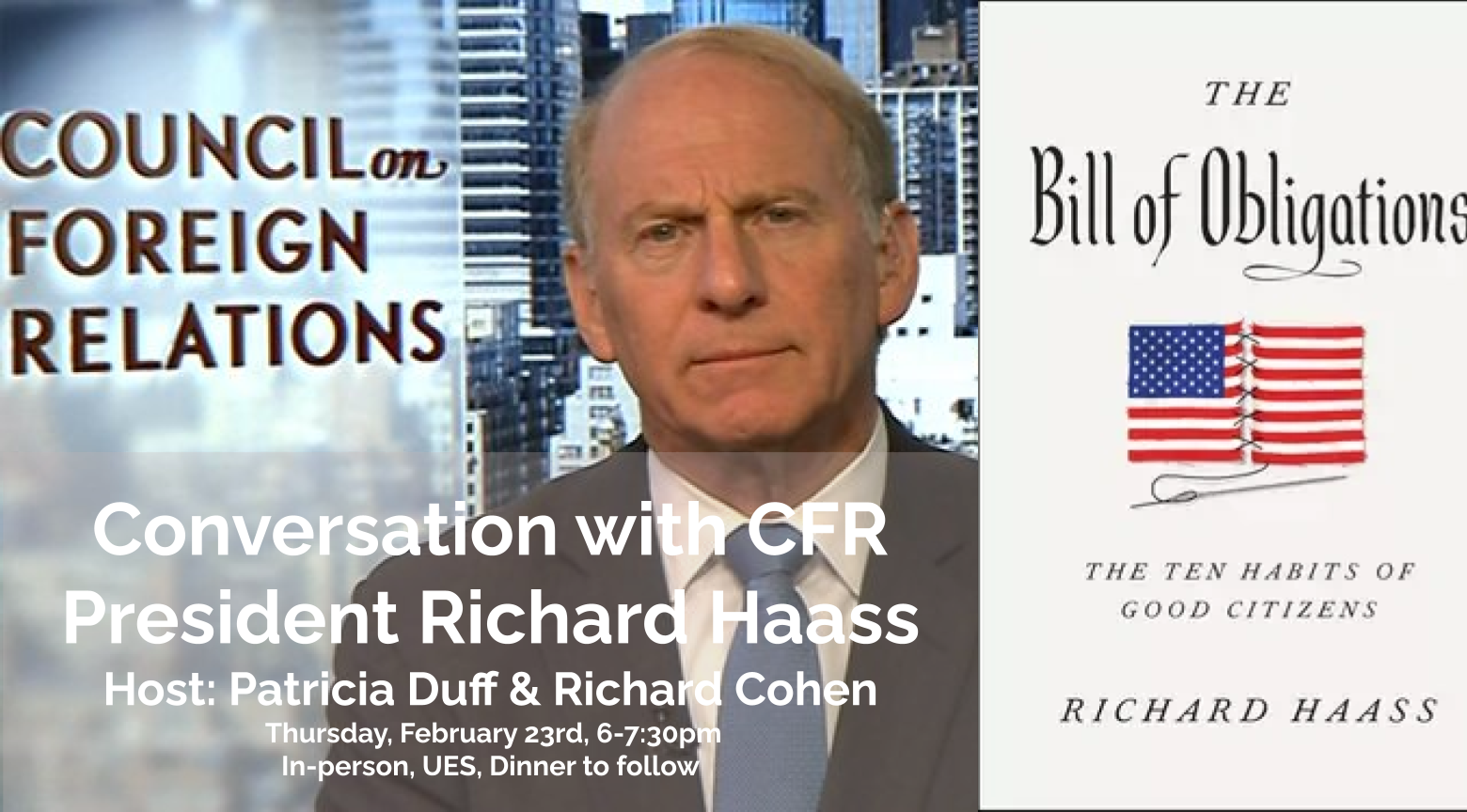

One of the nation’s most distinguished foreign affairs experts joins us to discuss the global outlook for 2023 and his important new book, Bill of Obligations, on the critical role of citizens in reclaiming our democracy.

Byron Wien, Vice Chairman of Blackstone, and Joe Zidle, Managing Director and the Chief Investment Strategist at Blackstone, return together for an important and timely conversation on the economy, the markets, and political and international events that may affect your portfolio, your business, or simply your peace of mind.

Live from the New York Historical Society discussing the violent and deadly January 6th Capitol insurrection to the wider efforts to overthrow the 2020 election we welcome Emmy Award-winning MSNBC anchor Ari Melber and renowned prosecutor Andrew Weissmann.

From the frontlines of the defense of the capitol where he was beaten, teargassed, and tazered to testifying at the January 6th Committee Hearing in the search for the truth: ex-DC Metropolitan police officer Michael Fanone discusses that fateful day and his life since.

Past Speakers

“This is a time to put partisanship aside, roll up our sleeves, and work even harder together to secure the values we hold dear - I thank The Common Good for your great work.”

Join Us

The change begins with you. The Common Good is a membership organization that consists of professionals with an interest in public policy and politics. TCG encourages civil dialogue and good government. We present the highest caliber thought leaders for candid discussions.

Twitter:

Instagram:

Let’s connect